By PAUL HAMMEL

Nebraska Examiner

LINCOLN — What’s billed as the largest tax cut in state history received final approval Thursday by state lawmakers, amid praise and worries.

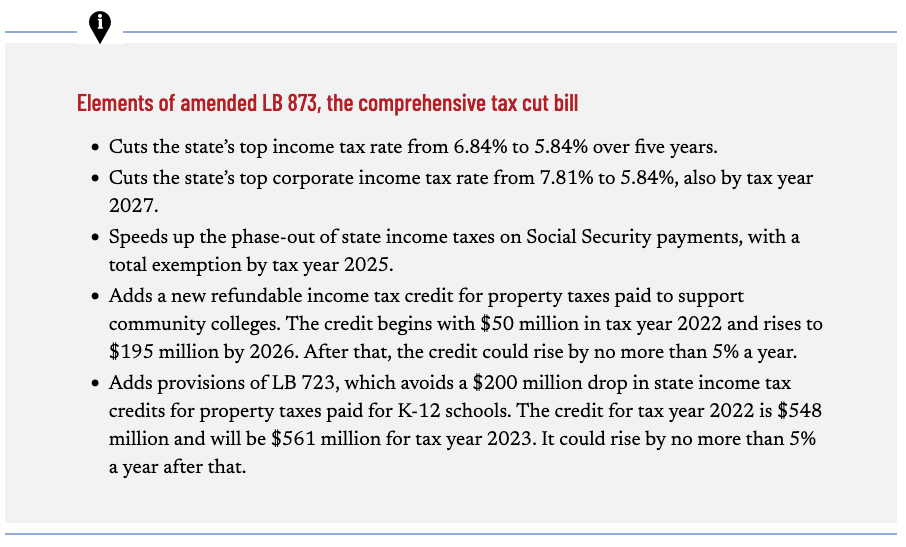

Legislative Bill 873, which phases in cuts in state individual and corporate tax rates, increases state property tax credits and eliminates certain state taxes by 2025, got third-round approval on a 43-0 vote.

The package, which would deliver nearly $900 million in cuts when fully implemented, now awaits a signature from Gov. Pete Ricketts, who has voiced support for it.

AARP praises bill

Praise for LB 873 came from the Nebraska AARP because of the eventual elimination of state taxes on Social Security income. Thanks also came from the Nebraska Chamber of Commerce and Industry and the Nebraska Farm Bureau.

Reducing state income taxes has been a longtime goal of the State Chamber and other business groups. They maintain that lowering individual and corporate income taxes is critical in attracting new businesses and workers.

“A dynamic, growing economy with lots to do and cutting-edge job opportunities is critical to attracting and retaining more people in Nebraska, especially our talented, young generations,” said Bryan Slone, president of the State Chamber.

In a compromise to gather more rural support, additional increases in state income tax credits were attached to LB 873 for property taxes paid for K-12 schools and community colleges.

Raises property tax relief

The Farm Bureau estimated Thursday that the provisions of LB 873 combined with a previous bill setting up the income tax credits would add up to $886 million in property tax savings a year within five years.

“Thrilled,” was the reaction from Farm Bureau President Mark McHargue.

But warnings came from an Omaha state senator and a Lincoln-based think tank.

State Sen. John Cavanaugh said he would have voted “no” had he been present for the morning vote. He said the bill is way too costly, and will provide income tax cuts mostly to high income Nebraskans.

$70 million to millionaires

“There has to be a better way to get tax relief to the middle class than giving $70 million in tax breaks to millionaires,” Cavanaugh said.

The Open Sky Policy Institute called the bill “bad news for most Nebraskans” and said it will eventually require cuts in state services, such as education and roads.

“The wealthy and out-of-state corporations will come out way ahead, while in time, everyday Nebraskans will likely end up footing the bill,” said Rebecca Firestone of Open Sky.

Tax receipts padded

OpenSky has argued that Nebraska’s healthy tax receipts in recent months have been artificially padded by federal COVID-19 aid and that state lawmakers should have exercised caution when making such deep cuts in state revenue.

But State Sen. John Stinner of Gering, who heads the Legislature’s budget-writing Appropriations Committee, has said the state can afford the tax cuts. He did win approval for a clause that would limit increases in the income tax credits to no more than 5% a year as a way to control costs.

Lincoln Sen. Mike Hilgers, the Speaker of the Legislature, called LB 873 the largest tax cut in state history. He praised state lawmakers for passing the tax cut package, while also increasing the state’s cash reserve and financing several state priorities.

Three attempts to advance

LB 873 took a circuitous course to passage. It was initially introduced by Omaha Sen. Lou Ann Linehan as LB 939 and only contained the income and property tax cuts.

When that bill stalled, an attempt was made to incorporate LB 939 into a hugely popular Social Security tax reduction bill, sponsored by Omaha Sen. Brett Lindstrom.

But that attempt was also blocked, so the provisions of LB 939 and LB 825, Lindstrom’s bill, were placed into LB 873, which overcame filibusters during first- and second-round debate before winning final approval Thursday.